From our partner LandGate

Methods of Land Valuation

Land valuation is the process of estimating the fair value of a parcel of land. There are three primary methods of land valuation:

Sales comparison approach

The sales comparison approach is the most used method. It involves analyzing recent sales of similar properties in the area to determine the market value of the land.

Income approach

The income approach is another method of land valuation that is primarily used for income-producing properties, such as rental properties or commercial buildings. This approach involves analyzing the property's income potential and comparing it to other similar properties in the area.

Cost approach

The cost approach is the final method of land valuation, and it involves analyzing the cost of building a similar property on the land and subtracting the depreciation of the property.

Location-Specific Considerations for Land Valuation

Certain areas in the U.S. are more valuable for certain resources that are natural, crops, or renewable. These factors impact both surface and mineral rights, but there are distinct differences between valuing the two.

Mineral Rights

The value of mineral rights differs greatly from state to state, and it is heavily dependent on location. The average price per acre for mineral rights could be anywhere from $250 to $10,000 per acre.

Here are the main factors that affect the value of mineral rights:

Location

Oil and gas production in the surrounding areas heavily impacts the value of mineral rights. There are certain areas across the United States that produce oil and gas, and some that don’t. These areas are called basins, and the U.S Energy Information Administration provides the names of all the basins and states located in them.

Producing or Non-Producing Minerals

Generally, producing minerals have a higher value than non-producing minerals since they generate revenue.

Oil & Gas Prices

A decrease in oil and gas prices typically results in lower value for mineral rights, and vice versa. This is because operators find it more challenging to generate revenue to proceed with their drilling operations.

Lease Terms

For leased minerals, the provisions in the lease have an impact on the value of mineral rights. For example, the lease may provide the operator with the opportunity to increase production and drill more wells, which can increase the value of mineral rights.

To determine the true value of mineral rights, mineral owners may consider getting a formal mineral rights appraisal.

Surface Rights

Like mineral rights, the position and location of land plays an important role in determining land value. However, there are many other factors that play a role in determining the value of surface properties:

Location

The Sales Comparison Approach used to value land relies on the specific location and size of a parcel. Generally, the value of land tends to increase for properties located near popular destinations, cities, and other services that are in demand. A remote property may have limited value because it does not have easy access to amenities, utilities, transportation, etc.

Environmental Risks

Land that is in a region that faces significant environmental risks may be less valuable than land that is located in less risky areas of the country. For example, if a property is in a 100-year flood zone, this may deter buyers.

Dwellings

Land appreciates in value across the United States because there is a limited supply of it, whereas physical structures, such as dwellings, tend to depreciate over time. When they purchase land, many investors consider how land appreciation can offset the depreciation of a home or similar dwelling on the property.

Water

Natural water is something that is typically acquired with the initial purchase of a property, and it can’t be added later. The presence of water rights generally increases the value of land and its possible future uses for recreation or farming.

Usable Land

Each piece of land is unique. When buyers are interested in purchasing a property for a specific purpose, they will be interested in knowing what percentage of that property will be productive. For example, for timberland investors, wetlands and steep areas may not be usable because machinery cannot access or operate in those areas.

Soil Types and Site Quality

When it comes to selling and buying land for a specific purpose, soil types are a crucial factor that affects land value. For example, prime farmlands have fertile soil. Loamy soils with high organic matter are well-suited for farming, and this increases the value of land for farming. The types of soil on land are also applicable to the value of land for carbon credits. When it comes to land development in general, soil types are a significant consideration because it impacts what can and cannot be developed on the land.

Minerals

In general, properties without mineral ownership tend to have lower values than those with mineral rights. For buyers invested in surface use of the property for recreational, residential, or agricultural purposes, having ownership of the mineral rights may not be as applicable. However, without mineral rights, the buyer forfeits any potential financial gains that could be made from extracting oil and gas.

Renewable Energy Potential

Solar and wind farm potential can be viewed in a similar way to oil and gas basins for mineral rights. Apart from the renewable energy incentives for developing solar and wind farms, there are certain areas in the U.S. that do better for solar and wind energy.

- Landowners on the east and west coast of the country have better solar leasing opportunities.

- Landowners in the Midwest, Northeast, and Texas have better wind leasing opportunities.

Energy developers can both purchase and lease land from landowners for solar farms or wind farms. If your land would work well for a solar or a wind farm, an energy developer will likely be willing to pay more for the land than they would otherwise.

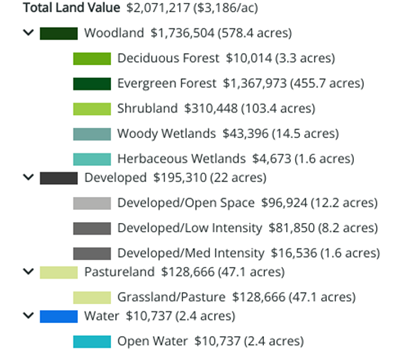

Impact of Land Types on Land Value

In this property report, an estimated value is provided for the land as a whole. This is calculated through an analysis of the different types of land on a given property, and the acreages available of each. The types of land that are analyzed are as follows:

Developed

Developed land refers to land that has been altered from its natural state, generally for industrial purposes. This type of land is typically worth the most given that there has been an investment to improve the property or to build something.

Woodland

In a broad sense, woodland is land covered by mixed forest ecosystems. Grasslands and shrub lands qualify as ‘woodlands.’ Prices for woodlands are also heavily dependent on location. People purchase woodlands for a variety of reasons including recreation, timber income, or for sustainability purposes. Woodlands that can be used for timber harvesting are generally the most valuable types of woodlands.

Cropland

Cropland simply refers to land on which agricultural crops are grown. According to the U.S. Department of Agriculture, cropland is generally more valuable than pastureland.

Pastureland

Pastureland is land that is used for the grazing of livestock as part of a farm or ranch. The value of pastureland across the country is steadily rising, but it is also dependent on location. Areas with little land remaining for development generate the highest prices for pastureland.

Water

The more water that a property has rights to, the more money it is worth. In fact, the value of water rights across the country is steadily increasing since water is a very finite resource.

Figure 1: Example Land Value Estimates from LandGate's Property Report

Overall, the value of land varies across the country, with the main influencing factors being the property's location and intended purpose. Other aspects of land will affect its suitability and cost for certain projects as well. For solar or wind farms, buildable acreage is something that affects the average price per acre. Similarly, the amount of topography and whether there are wetlands will affect the acres of land available for project development. For farming or agriculture, factors such as the soil types and access to water play a major role in determining the value of land.

Landowners and land brokers can get an estimated value for their land or land that they represent and its natural resources in LandGate's free property report, which factors in all of the above and more to provide you with an accurate online estimate.