Article contributed by Eckard Enterprises

Many investors assume that Section 1031 tax exchanges can’t be used to own assets like mineral rights—but that’s not entirely true. In most cases, mineral rights can indeed qualify for a 1031 exchange, allowing you to defer capital gains taxes when reinvesting in similar assets. However, there are important nuances to understand, including specific lease limitations and strict timeframes that could impact eligibility. Let’s break down what mineral ownership means, the benefits of owning them, and how 1031 exchanges work along with what you need to know when applying them to mineral rights.

Understanding Mineral Rights Ownership

Mineral rights are like real estate, flipped upside down. Instead of owning the land above ground, mineral rights owners own everything beneath the surface. These rights grant the holder the ability to extract minerals—or receive payment for their extraction. In the U.S., mineral rights function much like real estate: they can be sold, transferred, or leased separately from surface rights. Ownership can apply to an entire parcel, a fraction of it, specific minerals, or even certain depth intervals.

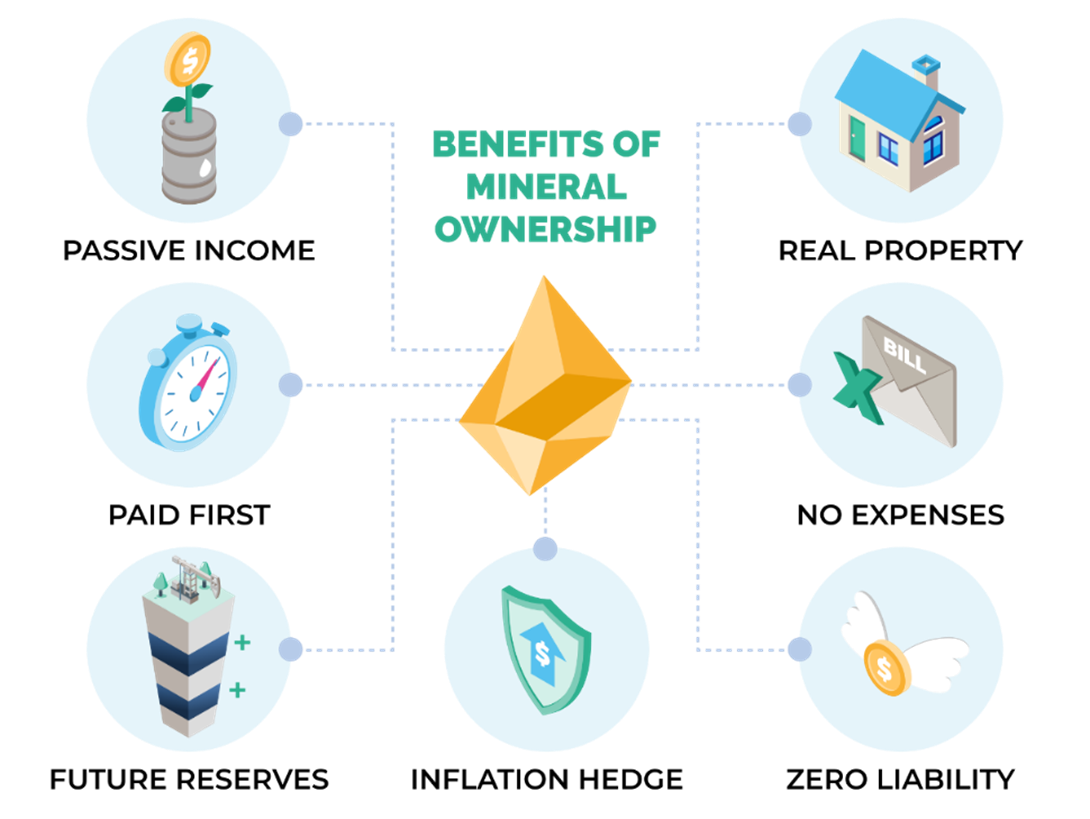

Mineral rights owners earn royalties from energy companies that lease and develop their minerals, often ranging from 12.5% to 25% of the revenue generated from the sale of the resources derived from the subsurface resources. Mineral rights are real property that are owned in perpetuity, like traditional real estate, so these payments can continue for years or even decades.

Even better, mineral rights owners don’t bear the costs of drilling, land development, or equipment maintenance. They also avoid the liabilities that fall on the oil companies conducting the extraction. After the initial purchase, mineral rights owners simply enjoy their monthly royalty checks.

Understanding Section 1031 Exchanges

Section 1031 is a provision in the IRS tax code that allows investors to defer capital gains taxes when they sell real property and reinvest the proceeds into a like-kind asset of equal or greater value. This means you can transition from one investment to another without immediately triggering a taxable event, keeping more of your capital working for you.

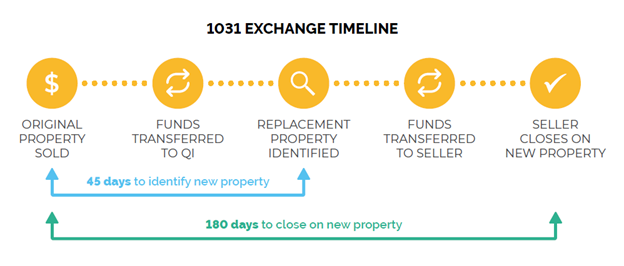

The primary benefit? Tax deferral. Instead of paying capital gains taxes upfront, you can roll the full proceeds into a new investment, potentially growing your portfolio faster. The catch? To qualify, the exchange must be done within specific time limits and meet certain IRS criteria.

How 1031 Exchanges Apply to Mineral Rights

Traditionally, 1031 exchanges cover real estate assets like land, residential properties, commercial buildings, and farmland. Since mineral rights are considered a real estate interest, they can also qualify for a 1031 exchange. However, not all mineral rights leases meet the criteria.

One key factor is whether the lease grants an ownership interest in the minerals themselves. If the lease only allows extraction of a fixed amount of minerals (rather than conveying an ongoing interest in the reserves), it may not be eligible for a 1031 exchange. Understanding these distinctions is critical before attempting a tax-deferred exchange.

Important Considerations for a Successful Exchange

If you're planning to use a 1031 exchange for mineral rights, here are a few essential points to keep in mind:

- Like-Kind Requirement: “Like-kind” doesn’t mean identical—it simply means the asset must be another form of investment or business property. For example, you could exchange a commercial building for undeveloped land or mineral rights for a rental property.

- Timing is Everything: The IRS requires you to identify potential replacement properties within 45 days of selling your current investment and complete the exchange within 180 days.

- Unlimited Exchanges: There’s no cap on how many times you can perform a 1031 exchange. As long as you continue reinvesting, you can keep deferring taxes indefinitely—until you eventually cash out and pay long-term capital gains taxes.

Making the Most of Your Ownership

Mineral rights can be a powerful addition to your real estate portfolio, and using a 1031 exchange is an effective way to transition into this asset class without an immediate tax hit. However, the key to a smooth exchange is preparation. Ensuring your mineral rights qualify under IRS rules before making a move is crucial.

The Eckard Enterprises team specializes in providing ownership opportunities in mineral rights and other royalty-generating energy assets. With 40 years of experience in the oil and gas industry, they believe tangible assets such as minerals can provide opportunities for qualified individuals to directly own one of the most secure and long-term income-generating assets available.

Interested in learning more? Contact Eckard Enterprises today to explore your options.